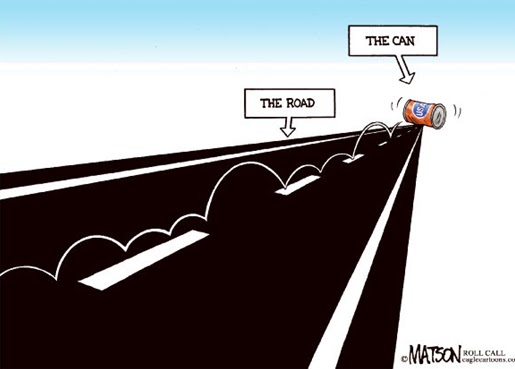

Forget kicking the can down the road. The euro is fast running out of road. The crisis in Cyprus marks a new milestone in the euro’s demise. The problems are getting bigger for the Eurozone and the ability of policymakers to patch the euro’s fractures back together again are looking increasingly in doubt. The Eurozone almost went to the brink over the Cyprus crisis and yet the economy there only accounts for a tiny 0.2% of Eurozone output. A minnow almost toppled the euro majors. In the lead-in to the crisis the euro cascaded nine big figures from the USD1.37 February peak. The subsequent rally from the USD1.2845 low last week has been pretty flaccid to say the least. It is beginning to dawn on the markets that the euro might now be fatally holed beneath the water-line. Try telling the Russian depositors who have lost their trousers in the Bank of Cyprus and Cyprus Popular Bank debaggings that the euro is a credible store of wealth. There will be many global central bank reserve managers who will be scratching their heads today about the viability of the euro as a premiership reserve currency. The euro should now be seen for what it is - an ultra low return-high risk currency. There will be many savers with deposits in excess of 100,000 euros in the troubled Eurozone periphery who will now be looking for much safer havens for their wealth. Given the enormity of what has just happened this weekend, the subsequent rally in risk assets has been pretty limp-wristed too. In the post-Lehman Brave New World, there is a growing cynicism that we are anywhere near redemption from the contagion. The words ‘lost ‘ and ‘decade’ spring to mind.

You have to pity the nation. Cyprus was a sacrificial lamb on the altar of German politics. Chancellor Merkel could ill-afford to show any further mercy or philanthropy with German federal elections breathing down her neck later this year. If there is a ‘rotten heart of Europe’ now, it is less the on-going peripheral contagion threat than the danger that voters in the Eurozone core have just had enough. The Eurozone is starting to show more symptoms of spinning apart. These centrifugal forces are not only coming from voters in the troubled periphery who have had enough of enforced austerity, but also emanating from voters in the core who wish to put a stop to endless bail-outs at their expense. Team Eurozone is no longer a dream – it’s a nightmare. It is interesting to see that the latest Sentix survey of investor confidence shows a record 41% in March expecting a Eurozone country to quit the euro in the next year, up sharply from 19.25% in February. The forces of instability for euro break-up are rising and no surprise considering the poor way that policy makers handled the crisis over Cyprus. The risks are probably even that a euro break-up will not only come from the bottom, but also the top. Ireland, Greece, Portugal and Cyprus are already feeling the heat in the kitchen. But it is not just the endemic risks facing Italy and Spain too, toiling under the excessive burden of austerity policies and uncertain politics. France is looking like it is coming close to ditching austerity in favour of pro-growth policies. Germany is looking increasingly like a country that has had enough. New View Economics expect that the euro will cease to exist in its current shape over the next five years and will be very lucky to survive the next two years.

Set against this backdrop, the risk asset rally has a hard task ahead. There are two conflicting forces. The post-July 2012 rally has been super-fuelled by the Big-Easy super-flood of central bank liquidity, bolstered by Draghi’s commitment to do whatever it takes to ensure the euro’s survival. The euro is the linch-pin now. Worries about euro-contagion have had a huge viral effect on risk asset sentiment in the last few years. As contagion breaks out again – which it will do – the markets will be hamstrung every time a debt crisis comes back onto the radar screen again. Unfortunately, investors have little alternative to stock markets as a higher yield play, while zero interest rates and low bond yields persist in the mainstream markets. It underlines the message that stock market performance looks set to experience a bumpy ride for the rest of 2013. As far as the euro is concerned, the substantive trend will be lower. The ECB will be forced into further tranches of liquidity injections to help restore calm into the troubled Euro-system. Much more ECB money must be poured into the Eurozone economy to ensure there is some semblance of life left in what is increasingly becoming a zombie economy outside of Germany. Given the German economic advisers’ down grade to 2013 GDP growth to 0.3% from the former 0.8% forecast, at least there is some dawning recognition now of the future dangers, unless a switch change of tack is adopted soon. The future for the euro will be bounded now by unfettered quantitative easing and the cachet of limited life-expectancy. A return to parity seems inevitable in the next 1-2 years.

No comments:

Post a Comment