If the ECB were to adopt a formal process of forward

guidance for monetary policy, then Eurozone rates should be going lower and the

ECB should be engaging a mass monetisation of Marshall Plan style proportions

to get the Eurozone back to work. The ECB is missing sustainable recovery by a

very wide margin. It is true that Eurozone economic sentiment is picking up,

but the recovery is very flaccid and the economy is only just emerging from six

long quarters of deep recession. It could be at least five years before

Eurozone growth is anywhere near to being back on its feet again. In the

meantime, employment opportunities will continue to stagnate. Eurozone

unemployment at 12.1% shows that the real economy is in dire straights and

underlines that the ECB must keep monetary policy super-accomodative for years

to come. The ECB must ignore all siren calls from German Bundesbank hawks to

normalise interest rates as soon as possible. Lacklustre growth,

ultra-high unemployment, falling headline inflation and negative credit

expansion all add up to the ECB not doing enough to guarantee sustainable

recovery for the Eurozone. Another rate cut or adopting formal quantitative

easing remain the key policy options on the table. But it’s doubtful that the

ECB have the courage to pick up the batten.

New View Economics is an independent consulting group. Macroeconomics and forecasting the financial outlook is the name of the game, using a holistic approach to getting the markets right.

Friday, 30 August 2013

Wednesday, 14 August 2013

Sound bites: Eurozone breaks its recession shackles in Q2

These are better than expected second quarter GDP numbers from the Eurozone, but it’s nothing for the ECB to celebrate. After six quarters of unrelenting recession misery, the Eurozone has finally broken back into positive growth. It is going to be a very long, hard haul back into sustainable, strong growth again. It is a tale of two very different economies. Germany is doing all the hard work in the vanguard of strong recovery as its 0.7% Q2 GDP expansion showed. On the other side of the equation, the troubled Eurozone economies are still mired down in the mud of deep recession risk. That risk will persist while heavy austerity policies continue pose a severe constraint on economic demand. While Germany continues to enjoy the fruits of export-led recovery boosting industrial activity and consumer demand, the Eurozone stragglers will continue to act as a millstone on growth for a long time to come. The Eurozone could be bouncing along close to the bottom of recession for quite a few more quarters yet. These numbers do not let the ECB off the hook for extended low rates. While the ECB hawks may be straining on the leash for higher rates soon, the ECB’s pro-stimulus work is far from over. Given the parlous state of the troubled Eurozone economies, the support of record low rates may be needed until well into 2015.

Sound bites: unemployment shows Bank of England in for the duration on 0.5% rates

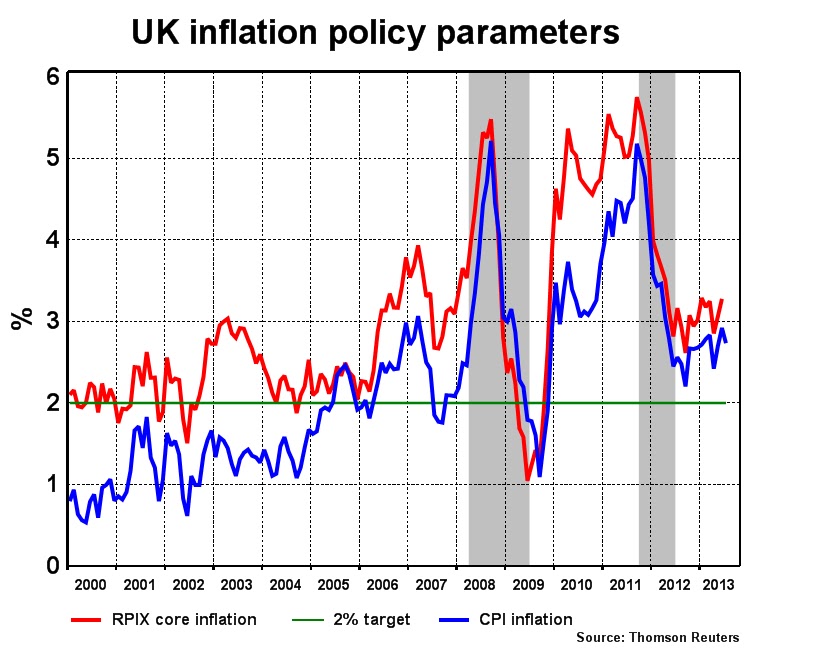

Judging by the slow rate of attrition in UK unemployment coming down, it looks like the Bank of England will be in for the duration on record low interest rates. Waiting for headline unemployment to come down from 7.8% to the key 7.0% policy threshold will be like watching wet paint drying. Conditionally, it is going to take a long time. The only potential circuit breaker that might engage quicker tightening from the Bank is the budding UK housing bubble. It seems as if a lot of the BOE’s monetary largesse is now being funnelled into the UK housing market. While this might be a good thing for rebuilding consumer confidence, the Bank will not want to see this unfold at the expense of its inflation targets. Headline UK inflation has only been allowed to live above its 2% target for so long out of consideration for the recession. That might change quite quickly if the UK housing market begins to show signs of heating up too quickly. It could spell the risk of the BOE bringing forward its expected rate tightening from 2015, earlier into 2014. This should continue to provide continuing support for sterling and intensify steepening pressure in the UK gilt yield curve

Tuesday, 13 August 2013

Sound bites: German ZEW points to continued gradual recovery in August

The August ZEW survey shows the German economy still in cautious, gradual recovery mode. The recovery is far from running away with itself, tempered down by worries about global economic slowdown, the risk of the US Fed’s easing cycle coming to an end soon and the continuing shadow cast by Eurozone uncertainties. Economic optimism seems to be in the ascendant again. The pick-up in economic sentiment seems to be well supported by the recovery in German demand across the board. This is mainly being driven by Germany’s burgeoning export sector, spreading into stronger industrial activity and better consumer confidence as employment prospects continue to pick up. The fact that Eurozone uncertainties are stabilising for the time being are being construed as a net positive for the economy. While the economic headwinds seem to be easing, it is still likely to be a long haul back to full health, although Germany seems to be well placed to be a major beneficiary once global economic fortunes are restored.

Sound bites: UK inflation too high for BOE comfort

The drop in UK headline inflation from 2.9% to 2.8% will give the UK monetary authorities little to celebrate. The Bank’s new-found forward guidance on interest rates based on unemployment may be one thing, but UK inflation is still stubbornly stuck too high for the BOE’s comfort. The underlying upward tendency in UK inflation amid clearer signs that the UK economy is throwing off the mantle of recession suggests that the Bank is not going to hang around too long with record low rates at 0.5%. There is a very strong chance that the BOE will go along with basic instinct and go for higher rates well before the next UK general election which must be held before May 2015. While the markets have been obsessed with BOE governor Carney throwing more fuel into the recovery, the odds are that the UK’s monetary stimulus tanks are already full to the brim and it may be time fairly soon to take its foot off the accelerator and back onto the brake. The recovery in the UK housing market and rising house price inflation will simply add to the Bank’s concerns that it might need to nip any impending housing bubble smartly in the bud. It is no surprise that the UK pound is starting to get a better spring in its step versus the dollar. The market is starting to get a much strong whiff of an early rate rise in 2014.

Subscribe to:

Comments (Atom)