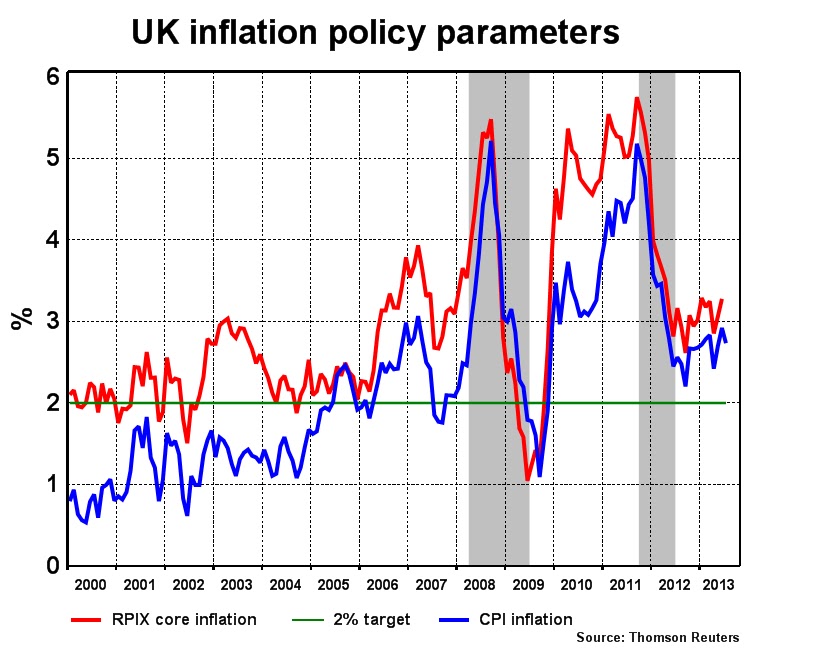

The drop in UK headline inflation from 2.9% to 2.8% will give the UK monetary authorities little to celebrate. The Bank’s new-found forward guidance on interest rates based on unemployment may be one thing, but UK inflation is still stubbornly stuck too high for the BOE’s comfort. The underlying upward tendency in UK inflation amid clearer signs that the UK economy is throwing off the mantle of recession suggests that the Bank is not going to hang around too long with record low rates at 0.5%. There is a very strong chance that the BOE will go along with basic instinct and go for higher rates well before the next UK general election which must be held before May 2015. While the markets have been obsessed with BOE governor Carney throwing more fuel into the recovery, the odds are that the UK’s monetary stimulus tanks are already full to the brim and it may be time fairly soon to take its foot off the accelerator and back onto the brake. The recovery in the UK housing market and rising house price inflation will simply add to the Bank’s concerns that it might need to nip any impending housing bubble smartly in the bud. It is no surprise that the UK pound is starting to get a better spring in its step versus the dollar. The market is starting to get a much strong whiff of an early rate rise in 2014.

No comments:

Post a Comment