Judging by the trading performance so far in 2016, it has not been the best of starts for global markets and the worry is that it sets the tone for another troubled year. Stock market mayhem and rising investor unease is not good news when the pace of global growth is starting to stumble.

It

is hard to credit after seven years of stock market rally that the bubble is

about to burst, especially considering the world economy is so flush with

liquidity after years of monetary pump-priming by the major central banks.

Ever

since the global financial crisis first exploded onto the scene in 2008, world

policymakers have waged a fierce policy offensive with quantitative easing,

ultra low interest rates and a plethora of super-stimulus to get the world economy

back on its feet. Despite all this monetary balm, markets seem to have reached

a crossroads.

The

special measures have either run out of steam and fresh policy efforts are

needed, or else global stock markets have reached their natural peak and are

set for a corrective downward spell. It is a combination of both, plus the fact

that the global economy is still experiencing painful aftershocks from the

global financial crisis.

Reverberations

of deep recession, deflation, high unemployment, austerity cutbacks and severe

balance sheet restructuring are still resonating. Years of easy money from the

global monetary authorities might have averted deeper disaster in the immediate

aftermath of the 2008-9 financial crisis but the world economy is still far

from fixed.

Stock market uncertainty is telling the world’s economic leaders some important truths. Stock prices are forward leading indicators of investors’ future expectations. If share markets are distressed it means confidence in the future has been undermined. Investors selling assets is the only way to limit anticipated risks ahead.

Central

bankers have railed in recent years over ‘irrational exuberance’, excessive investor

risk-taking and the dangers of stock market bubbles but the tables have now turned.

Global policymakers must acknowledge the market’s rising ‘rational despair’ and

do something much more meaningful to correct it.

There

have been telltale signs of deepening troubles in the world economy for quite a

while. Swathes of economic reports and downbeat confidence surveys have pointed

to global growth losing significant forward momentum. Slower growth in China, tensions

in the Middle East and the collapse in global commodity prices are all weighing

on global optimism right now.

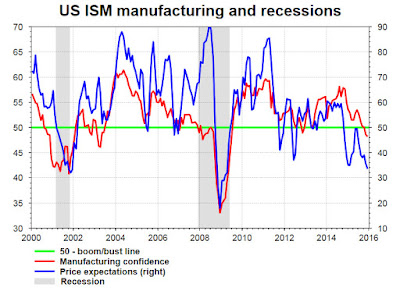

Purchasing

managers reports have highlighted the weakening trend of global economic

activity for well over a year. Compared with 12 months ago, many major

economies have edged below the critical 50 boom-or-bust threshold, suggesting

economic growth is heading into a contractionary phase.

Critically,

the US manufacturing PMI has seen a sharp reversal in fortunes over the last

year, with surveys suggesting the pace of US economic demand is slowing down

quite rapidly. This is in sharp contrast with the picture portrayed by the fast

pace of US employment expansion in last week’s 292,000 non-farm payrolls surge

for December.

Right

now, the US Federal Reserve seems solely focused on stronger employment trends and

ignoring the unsettling PMI message. The data not only alludes to weaker

economic activity ahead, but also pin-points a continuing deflation threat with

price expectations running at their lowest level for nearly 7 years.

The

worrying aspect is the Fed remains so dead set on pushing rates higher. The

Fed’s whispering campaign suggests a number of key officials would even prefer to

see 4 to 5 more rate rises this year. If the Fed is so determined to press

ahead with tightening, the bigger risk is at what stage the central bank starts

the ‘great unwind’ of its 4-1/2 trillion dollar hoard of QE purchases. That would

spark a major blow-out in US bond yields.

It

is the sting in the tail for investors. With the world’s largest economy so committed

to policy tightening, it means borrowing rates for the indebted nations around

the world are going up. This is bad news for global economic confidence and

growth.

There

are few places left for investors to run and hide. Traditional safe haven bond

markets, like German government bonds, are heavily over-subscribed and carrying

negative yields across much of the yield curve. The investment challenge this

year will be finding secure boltholes, with negligible risk and positive

expected return.

2016

has the makings of a really tough year for investors. But it will be even more

demanding for global policymakers seeking solutions.

This comment has been removed by a blog administrator.

ReplyDelete