Germany’s ZEW economic sentiment index continues to signal

cautious progress in the recovery cycle. Let us just hope that economic spring

is not going to turn into economic autumn. The German economy is still moving

forward but it is still against significant headwinds. The weaker parts of the

Eurozone economy are still casting a long shadow. German export recovery could

drag under the effect of the slowdown in emerging markets. And there is still

the threat of an early tapering in the US Fed’s monetary stimulus. Any one or

all of the factors combined might pose a large headache for recovery confidence

in German industry. For the time being the forward momentum in ZEW economic

sentiment is looking reasonably self-assured, but it is not quite out of the

woods yet. There is still a long way to go before Germany and the Eurozone are

back on terra firma.

New View Economics is an independent consulting group. Macroeconomics and forecasting the financial outlook is the name of the game, using a holistic approach to getting the markets right.

Tuesday, 17 September 2013

Friday, 6 September 2013

Sound bites: Germany's recovery outlook cautiously optimistic

There are two words which sum up Germany’s recovery outlook

– cautiously optimistic. It is a Goldilocks growth outlook – not too hot, not

too cold, but just right. Germany’s recovery is making positive ground with

industrial orders and output both showing good underlying growth performance -

and not at the expense of its Eurozone partners. Germany’s growth model maybe

changing a little this time around, with exports less the leading edge and

German consumers starting to show better signs of spending more thanks to low

unemployment. If growth looks more balanced between domestic demand and

exports, it should be to the net benefit of the Eurozone as a whole as import

penetration starts to pick up for its Eurozone trading partners. German

industrial production dipped by 1.7% in July, but this was largely the result

of a correction from the strong 2% growth spurt in June. It is nothing to worry

about as the underlying recovery trend remains intact. It is far too soon for

German policymakers to be talking about the ECB normalising interest rates back

towards higher levels. The German recovery is still in need of more nurturing,

while the troubled Eurozone economies are still need significant nursing. While

there is bound to be a battle royal between Bundesbank hawks and ECB doves,

Draghi’s forward guidance on keeping rates low, if not lower, over the future

should prevail.

Sound bites: still too early to get excited about UK industrial rebound

The UK industrial output data underline that it is far too

early to get excited about a vigorous rebound in the UK real economy. Recent

economic surveys may be pointing to stronger recovery, but there is still a

wide gulf between sentiment and what is slowly evolving in the real economy.

The UK is still on a long slow road to economic revival after the twin

recessions and there is not going to be any miracle turnaround to fast track

growth for the foreseeable future. UK economy suffered untold damage in the

wake of the credit crunch and it is going to take many years yet before the

all-clear is sounded. Chancellor Osborne was quite right to caution about

getting carried away with too much optimism about the economy. Bank of England

Governor Carney’s low rate strategy looks well intact for the time being. There

will be no early upward adjustment to UK interest rates. The markets have been

getting too carried away with talk of early UK rate hikes and policy tapering,

so the pound is long overdue a short term downward correction.

Thursday, 5 September 2013

Sound bites: ECB obliged to keep super-easy bias

The ECB’s monetary radar screens should be signalling that

rates must stay at record low levels for a long time – if not lower. Parts of

the Eurozone are crawling out of recession but the threat of further growth

wobbles is never too far away. Germany is an exception and pulling into

recovery, but the troubled Eurozone economies are still in dire straights. The massive debt burden, bank balance sheet restructuring and over-tight fiscal policies

continue to take their toll on the weak links in the Eurozone economy. Low core

inflation, high unemployment and domestic credit contraction are all symptoms

of monetary policy needing to give extra zest to monetary stimulation. Interest

rates at 0.5% are helping in some part, but the ECB needs to pump prime much

more monetary liquidity into recovery efforts. At some stage, the ECB will need

to work a more effective means of quantitative easing into equation, or else

the Eurozone will be blighted with double digit unemployment for many years to

come. This poses the greatest risk to EMU’s survival in the long run, so it is

a case of the ECB having to face up to the reality of sink or swim for the euro

at some stage soon. Economic pragma and political reality will have to

transcend ECB and especially German Bundesbank dogma.

Sound bites: the Bank of England stays steady

The Bank of England is under no pressure to do nothing other

than sit on its hands on rates and further quantitative easing for quite a

significant time. It looks like the implied forward guidance for no rate hikes

until 2016 remains intact. The economy has got a better spring in its step, but

the recovery still carries a sizeable limp from the recent twin recessions. The

economy will still take some significant nursing and nurturing with rates held

steady at 0.5% for a long while. There is no threat of any potential circuit

breakers for higher rates. The only aspect that the BOE will need to pay some

attention to might be possible overheating in the housing recovery, but this is

still in its infancy with no guarantee of sustainability. The housing market is

simply expressing a rebound from five years of stagnation. For the time being,

Carney and the MPC would be best advised to stick to fence-sitting and wait and

see.

Sound bites: German orders trend shows continuing recovery

Despite July’s 2.7% dip in German orders, the underlying

trend remains strong and shows the German recovery gathering greater vigour.

Given the 5% orders surge in June, the July correction is no surprise. Domestic

demand is springing back and the export sector remains on track for continuing

good growth. The economy is coming back onto its long term output growth

potential. Given this backdrop it is no wonder there is a growing chorus

amongst German officials for an end to the ECB’s super-easy interest rate

policy. The call is going to fall on deaf ears as the economies outside Germany

remain in a sorry state and still pose a heavy millstone around Germany’s neck.

The ECB will stay the course on over-easy monetary policy until 2015 at least.

If the ECB were to adopt a formal forward guidance policy on rates based on the

Eurozone’s 12.1% unemployment rate, monetary policy could stay super-easy for a

lot longer than 2015.

Friday, 30 August 2013

Sound bites: High Eurozone unemployment, falling inflation and flaccid recovery point to super-accomodative ECB policy for years.

If the ECB were to adopt a formal process of forward

guidance for monetary policy, then Eurozone rates should be going lower and the

ECB should be engaging a mass monetisation of Marshall Plan style proportions

to get the Eurozone back to work. The ECB is missing sustainable recovery by a

very wide margin. It is true that Eurozone economic sentiment is picking up,

but the recovery is very flaccid and the economy is only just emerging from six

long quarters of deep recession. It could be at least five years before

Eurozone growth is anywhere near to being back on its feet again. In the

meantime, employment opportunities will continue to stagnate. Eurozone

unemployment at 12.1% shows that the real economy is in dire straights and

underlines that the ECB must keep monetary policy super-accomodative for years

to come. The ECB must ignore all siren calls from German Bundesbank hawks to

normalise interest rates as soon as possible. Lacklustre growth,

ultra-high unemployment, falling headline inflation and negative credit

expansion all add up to the ECB not doing enough to guarantee sustainable

recovery for the Eurozone. Another rate cut or adopting formal quantitative

easing remain the key policy options on the table. But it’s doubtful that the

ECB have the courage to pick up the batten.

Wednesday, 14 August 2013

Sound bites: Eurozone breaks its recession shackles in Q2

These are better than expected second quarter GDP numbers from the Eurozone, but it’s nothing for the ECB to celebrate. After six quarters of unrelenting recession misery, the Eurozone has finally broken back into positive growth. It is going to be a very long, hard haul back into sustainable, strong growth again. It is a tale of two very different economies. Germany is doing all the hard work in the vanguard of strong recovery as its 0.7% Q2 GDP expansion showed. On the other side of the equation, the troubled Eurozone economies are still mired down in the mud of deep recession risk. That risk will persist while heavy austerity policies continue pose a severe constraint on economic demand. While Germany continues to enjoy the fruits of export-led recovery boosting industrial activity and consumer demand, the Eurozone stragglers will continue to act as a millstone on growth for a long time to come. The Eurozone could be bouncing along close to the bottom of recession for quite a few more quarters yet. These numbers do not let the ECB off the hook for extended low rates. While the ECB hawks may be straining on the leash for higher rates soon, the ECB’s pro-stimulus work is far from over. Given the parlous state of the troubled Eurozone economies, the support of record low rates may be needed until well into 2015.

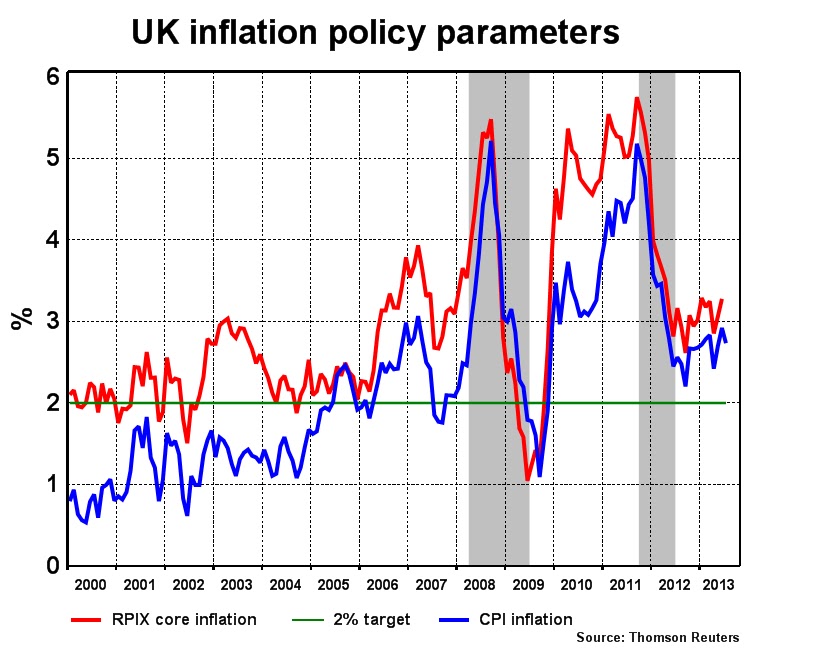

Sound bites: unemployment shows Bank of England in for the duration on 0.5% rates

Judging by the slow rate of attrition in UK unemployment coming down, it looks like the Bank of England will be in for the duration on record low interest rates. Waiting for headline unemployment to come down from 7.8% to the key 7.0% policy threshold will be like watching wet paint drying. Conditionally, it is going to take a long time. The only potential circuit breaker that might engage quicker tightening from the Bank is the budding UK housing bubble. It seems as if a lot of the BOE’s monetary largesse is now being funnelled into the UK housing market. While this might be a good thing for rebuilding consumer confidence, the Bank will not want to see this unfold at the expense of its inflation targets. Headline UK inflation has only been allowed to live above its 2% target for so long out of consideration for the recession. That might change quite quickly if the UK housing market begins to show signs of heating up too quickly. It could spell the risk of the BOE bringing forward its expected rate tightening from 2015, earlier into 2014. This should continue to provide continuing support for sterling and intensify steepening pressure in the UK gilt yield curve

Tuesday, 13 August 2013

Sound bites: German ZEW points to continued gradual recovery in August

The August ZEW survey shows the German economy still in cautious, gradual recovery mode. The recovery is far from running away with itself, tempered down by worries about global economic slowdown, the risk of the US Fed’s easing cycle coming to an end soon and the continuing shadow cast by Eurozone uncertainties. Economic optimism seems to be in the ascendant again. The pick-up in economic sentiment seems to be well supported by the recovery in German demand across the board. This is mainly being driven by Germany’s burgeoning export sector, spreading into stronger industrial activity and better consumer confidence as employment prospects continue to pick up. The fact that Eurozone uncertainties are stabilising for the time being are being construed as a net positive for the economy. While the economic headwinds seem to be easing, it is still likely to be a long haul back to full health, although Germany seems to be well placed to be a major beneficiary once global economic fortunes are restored.

Sound bites: UK inflation too high for BOE comfort

The drop in UK headline inflation from 2.9% to 2.8% will give the UK monetary authorities little to celebrate. The Bank’s new-found forward guidance on interest rates based on unemployment may be one thing, but UK inflation is still stubbornly stuck too high for the BOE’s comfort. The underlying upward tendency in UK inflation amid clearer signs that the UK economy is throwing off the mantle of recession suggests that the Bank is not going to hang around too long with record low rates at 0.5%. There is a very strong chance that the BOE will go along with basic instinct and go for higher rates well before the next UK general election which must be held before May 2015. While the markets have been obsessed with BOE governor Carney throwing more fuel into the recovery, the odds are that the UK’s monetary stimulus tanks are already full to the brim and it may be time fairly soon to take its foot off the accelerator and back onto the brake. The recovery in the UK housing market and rising house price inflation will simply add to the Bank’s concerns that it might need to nip any impending housing bubble smartly in the bud. It is no surprise that the UK pound is starting to get a better spring in its step versus the dollar. The market is starting to get a much strong whiff of an early rate rise in 2014.

Thursday, 25 July 2013

Sound bites: UK economy coming in from the cold in Q2

At long last the UK economy has some welcome news. The economy is coming out of the shadows, with a doubling in its quarterly growth rate from 0.3% in Q1 to 0.6% in Q2. The recovery is not quite on dry land yet, but at least it is a step in the right direction. We need a lot more quarters’ growth like this before the Bank of England’s repair work is done. With so much potential stimulus being drained out of the recovery by the government’s austerity programme, the BOE will need to keep applying its monetary balm for a lot longer. There is no chance of a BOE rate hike before 2015 and the odds of additional tranches of Bank support are still high. The UK economy may be coming in from the cold but there is still a fair degree of warming up to do yet.

Sound bites: Eurozone recovery restrained by negative credit and too slow money supply growth

Eurozone recovery is being severely impeded by negative credit growth. If the ECB wants to release the Eurozone from its recession shackles it must free up a much better supply of credit to the Eurozone economy. The credit crunch is deepening. Bank loans to the Eurozone private sector are contracting at a faster pace, falling by 1.6% in June compared to -1.1% in May. This cannot sustain recovery in any credible shape or form. The detail looks deeply concerning. Bank loans to the corporate sector are contracting at a 3.2% annual pace, while consumer credit is shrinking by 3.6%. It is less a question of getting rates lower or providing extra market liquidity to get the recovery going. The ECB and Eurozone governments need to take a big stick to the banks to get lending going again. It is less a case of draconian bank capital requirements hampering lending, the banks just do not seem to want to lend full stop. The fact that Eurozone money supply has decelerated again to 2.3% in June from 2.9% in May shows the scale of the problem. The reference target rate for M3 money is supposed to be 4.5%, consistent with 2% inflation and 2.5% growth. The ECB is well adrift from that now. It needs to start pump priming very soon or else face disaster for recovery prospects in the beleaguered Eurozone economies

Sound bites: German IFO business climate index building a better head of steam in July

Germany’s IFO index shows that the recovery is gradually getting back into its stride with a little bit more gusto. The economy is starting to build a better head of steam, thanks to the export sector and the fact that consumers seem to be gaining better confidence. If the improvements continue at this rate Germany could see growth upwards of 1% this year and 2% next year. It all still remains conditional on the rest of the Eurozone holding steady and contagion pressures easing. The Eurozone still remains the albatross round the German recovery’s neck. So far so good.

Thursday, 6 June 2013

Sound bites: ECB policy unchanged, but leaving them a lot to do

No surprises that the ECB have left policy unchanged as they wait for the next spark for action. The ECB needs to look no further than the economy for clear signs that they have a lot more easing to do. The Eurozone economy is crying out for easier monetary policy. Inflation and money supply growth falling well below target, the domestic credit contraction and chronic recession all underline that the ECB’s monetary policy settings are still far too tight. Draghi is clearly poised to cut rates again at some stage. The problem is that they are running out of ammunition with lower rates as a policy stimulant. There is probably only one more rate cut bullet left in the bag. The marginal effect of one further quarter point rate cut will be next to nothing other than symbolic.

It is down to much more conventional monetary easing and the introduction of ‘special’ measures to get the recovery underway and to avoid the risk of Eurozone deflation going viral. Germany’s economy may be doing ok and keeping its head above water, but most of the rest of the Eurozone is drowning in recession. It is time to act and act soon. The ECB needs to lubricate prospects for recovery with much better access to cheap credit for consumers and small and medium sized enterprises. The continuing contraction in Eurozone private sector loans underlines that the money already released by the ECB into the system is not getting through to borrowers. This is not a demand problem, but a supply constraint. The banks are keeping back ECB funding for their own prudential balance sheet protection. If the banks are holding up funding going into the economy, then they are starving recovery of vital sustenance. The ECB needs to act on this fast and impose lending incentives for the banks. At some stage, the ECB will also need to exorcise their demons and consider quantitative easing as another vehicle for pump-priming recovery. After all, if it has worked for the US and is starting to bear fruit in Japan, it needs careful consideration in the Eurozone now.

Sound bites: UK Bank of England policy on hold awaiting Carney

No great surprise that the Bank of England’s MPC have sat on their hands for another month. UK monetary policy is firmly on hold until new man Carney comes in to head up the monetary policy committee next month. Then we will see if the monetary sparks start to fly again. With some early signs of recovery starting to bud in the economy, it might be a good few months until Carney launches any new monetary initiative. Carney is unlikely to hit the ground running and will probably prefer to watch, wait and see whether QE needs another top up. There is probably an evens chance whether another £25bn top up will be required later this year. In all probability, the new emphasis of MPC policy will probably steer towards microeconomic initiatives like the Bank’s Funding for Lending Scheme. Ready and available access to cheap credit for personal and small and medium company borrowers will probably be a key means for the BOE to help lubricate recovery ahead, especially while the government’s austerity policies continue to take their toll.

Sound bites: April's 2.3% dip in German new orders does not signal the start of a new downturn

April’s 2.3% dip in German new industrial orders is nothing to worry about. It comes on the heels of two very strong months of new orders expansion in February and March. It does not detract from the German recovery which is moving well into its stride now. German exports have been the bright spot in the German recovery and foreign orders seem to be trending back towards their long term growth potential. The key for sustainability going forwards will be the health of Germany’s economic partners in the Eurozone. Unless these get back into better shape, they could start to throw an anchor out behind German export growth since the Eurozone accounts for such a large slice of German foreign trade.

Outside of Europe, the picture remains much brighter. Beyond Europe, capital and investment goods orders are still faring well as the global economy continues to tool up for recovery ahead. German capital goods orders outside of Europe continue to move above trend. This should be an important bellwether for world growth potential.

On a two month trend, new German export orders are up 0.6% compared with a year ago, a positive result considering the dismal economic picture in the Eurozone. German domestic orders are down 2.2% compared with a year ago. Domestic demand should eventually be re-vitalised by the wave of positive pay awards in Germany boosting disposable incomes and consumer spending power. The outlook is a lot brighter than the latest figures suggest.

APRIL 13 MARCH 13

Index Pct Index Pct

change change

Total domestic orders 99.8 -3.2 103.1 +2.0

Total foreign orders 106.2 -1.5 107.8 +2.7

of which euro zone 94.6 -3.6 98.1 +4.0

non-euro zone 114.3 -0.2 114.5 +1.9

Intermediate goods 99.4 -1.9 101.3 +3.4

Of which: domestic 97.7 -4.0 101.8 +3.8

foreign 101.5 +0.8 100.7 +2.9

of which euro zone 97.9 -3.5 101.5 +5.8

non-euro zone 104.9 +5.0 99.9 unch

Capital goods 105.7 -3.6 109.7 +2.2

Of which: domestic 102.2 -3.2 105.6 +0.7

foreign 107.8 -4.0 112.3 +3.2

of which euro zone 89.5 -7.0 96.2 +3.9

non-euro zone 117.8 -2.7 121.1 +2.9

Consumer goods, durables 106.6 +7.5 99.2 -0.8

Of which: domestic 98.6 +2.4 96.3 +0.5

foreign 113.5 +11.7 101.6 -1.8

of which euro zone 109.4 +14.8 95.3 -1.5

non-euro zone 118.0 +8.7 108.6 -2.2

Index Pct Index Pct

change change

Total domestic orders 99.8 -3.2 103.1 +2.0

Total foreign orders 106.2 -1.5 107.8 +2.7

of which euro zone 94.6 -3.6 98.1 +4.0

non-euro zone 114.3 -0.2 114.5 +1.9

Intermediate goods 99.4 -1.9 101.3 +3.4

Of which: domestic 97.7 -4.0 101.8 +3.8

foreign 101.5 +0.8 100.7 +2.9

of which euro zone 97.9 -3.5 101.5 +5.8

non-euro zone 104.9 +5.0 99.9 unch

Capital goods 105.7 -3.6 109.7 +2.2

Of which: domestic 102.2 -3.2 105.6 +0.7

foreign 107.8 -4.0 112.3 +3.2

of which euro zone 89.5 -7.0 96.2 +3.9

non-euro zone 117.8 -2.7 121.1 +2.9

Consumer goods, durables 106.6 +7.5 99.2 -0.8

Of which: domestic 98.6 +2.4 96.3 +0.5

foreign 113.5 +11.7 101.6 -1.8

of which euro zone 109.4 +14.8 95.3 -1.5

non-euro zone 118.0 +8.7 108.6 -2.2

Two-month comparison April/March 13 with previous two months:

Industrial orders +2.3

Domestic orders +1.4

Foreign orders +3.0

of which euro zone +2.8

non-euro zone +3.1

Intermediate goods +2.9

Capital goods +1.9

Consumer goods, durables orders +1.9

Unadjusted two month comparison April/March with same period a year ago:

Industrial orders -0.6

Domestic orders -2.2

Foreign orders +0.6

Intermediate goods -0.4

Capital goods -1.0

Consumer goods, durables orders +0.7

Friday, 31 May 2013

Sound bites: Eurozone inflation and unemployment hightlight Eurozone policy still too tight

Eurozone inflation has accelerated to 1.4% in May from 1.2%, while unemployment continues its relentless upward ascent, hitting 12.2% in April. The Eurozone’s economic woes are piling up. Low inflation and record high unemployment show in stark relief that Eurozone monetary and fiscal policy is far too tight. Recession still holds sway. There will be no relief until the ECB eases monetary policy dramatically and Eurozone governments steer fiscal policy resolutely away from austerity. Recession, low inflation, domestic credit contraction and high unemployment underline that the Eurozone is heading for a catastrophe unless the authorities act quickly.

The ECB needs to get rates down to zero and embark on a massive programme of quantitative easing as soon as possible. The Eurozone needs to be flooded with easy money and a surfeit of cheap credit. Austerity needs to be ditched as soon as possible and fiscal policy needs to be switched into counter-cyclical, pro-growth stimulus. A return to Keynesian economic regeneration is needed right now. German opposition has to be ignored. Without a massive sea-change in policy soon, the Eurozone risks being condemned to years of bouncing along the bottom of recession. A plunge into depression could be waiting in the wings, putting the EU experiment at deep risk.

Thursday, 30 May 2013

Sound bites: Eurozone economic confidence recovers to 89.4 im May from April's 88.6

Eurozone economic sentiment might have recovered modestly in May, but the outlook for growth still appears exceptionally grim. There is nothing to celebrate yet in these figures. The veil of uncertainty over recent debt crisis fears might have lifted somewhat, but Eurozone economic confidence is still stuck in a deep rut. It’s going to take a lot more than present stimulus initiatives to mend the Eurozone’s ailing economy. Government austerity, deepening recession and high unemployment are all taking their toll on confidence. Clearly, there is a clarion call for the Eurozone authorities to change tack and do a lot more to revitalise recovery prospects.

At least the ECB have responded to some degree by cutting rates to historic lows while some governments are starting to turn their backs on tougher austerity. But the ECB’s work is not over yet and there is still much more to be done on the monetary easing front. Also Eurozone fiscal policies need to be reversed from austerity to out-and-out pro-growth economic regeneration. Without change, the Eurozone will be condemned to years to on-going recession and vibrant recovery could be denied for at least a further decade. Japan has already been there and it is time that Europe woke up to the risks of a very avoidable mistake. Policy needs to change and it needs to change quickly.

Wednesday, 29 May 2013

Sound bites: Weak Eurozone M3 money supply remains on a weak trend

Eurozone M3 money supply has accelerated to 3.2% in April from 2.6% but it does not let the ECB off the hook for further policy easing. M3 growth is still operating well below the ECB’s 4.5% growth target. The weak trend of Eurozone M3 money supply in the last few years tells us exactly why the Eurozone is stuck in recession. The Eurozone is suffering domestic credit contraction rather than the vital credit expansion that is absolutely vital life-blood for recovery. Lending growth is still stuck in negative territory at -0.9%. Consumers and the corporate sector are being starved of the cash needed to fund stronger economic activity. Consumers need access to more credit to support spending. Companies need access to easier credit to finance investment and growth. Neither are getting it. Without it, vibrant Eurozone recovery could be denied for years. The ECB has passed plenty of liquidity through to the banks in the last few years. The banks are simply not passing it through to the people who need it most.

The ECB can only go so far with policy in its conventional sense. Rates have come down to rock bottom and the Eurozone has supposedly been awash with liquidity. But it is not reaching the parts of the economy that really need it. There is still a strong case to extend conventional easing into other shapes and forms. Banks need to come under some strong duress to meet lending targets and there is probably a strong case now for extra measures, including quantitative easing. With Eurozone inflation and money supply growth both operating well below their specified official targets, the ECB has a very clear signal that monetary policy is still too far too tight and needs to be eased a lot further if Eurozone recovery has any chance of seeing the light of day before 2015.

Friday, 24 May 2013

Sound bites: German IFO business climate taps into more positive vein in May - rises to 105.7 from 104.4 in April

Finally German business confidence seems to be tapping into a more positive vein. It seems to be homing in on the brighter recovery signals in the economy and putting the bad news of the Eurozone debt crisis behind it. Business sentiment is recovering, consumer sentiment is picking up and Germany has been spared a double dip recession by the skin of its teeth. German exports are doing better, consumer confidence has more spring and the stronger tone in the German stock markets will have boosted optimism. Business sentiment should also have been encouraged by the ECB’s on-going commitment to keep monetary policy at a very accommodative setting. The German economy may be coming out of casualty and faring a little better in recovery, but a return to fuller health still needs a lot more care and attention.

Germany is in no isolation ward. It’s recovery is critically dependent on the health of its partners in the Eurozone, who are faring a lot worse. For its own on-going recovery, Germany needs to ensure that the grounds for growth are set in motion elsewhere in the Eurozone. It needs to give its full blessing to the ECB’s monetary stimulus and it also needs to give much better consent to other Eurozone governments ditching tougher fiscal austerity in favour of more growth oriented budget policies. The IMF has already identified the need for Keynesian counter-cyclical stimulus in the Eurozone. Hard as it may seem for Germany, it must adopt a similar position or else any hopes for Eurozone recovery and fuller growth in Germany will wither on the vine.

GERMANY MAY 2013 APRIL 2013 MAY 2012

BUSINESS CLIMATE 105.7 104.4 106.6

BUSINESS CLIMATE 105.7 104.4 106.6

CURRENT CONDITIONS 110.0 107.3 113.0

FUTURE EXPECTATIONS 101.6 101.6 100.6

FUTURE EXPECTATIONS 101.6 101.6 100.6

The headline business climate index compared with the Reuters consensus forecast for a reading of 104.5

Wednesday, 22 May 2013

Sound bites: UK retail sales plummet 1.3% mom in April

The weak UK retail sales data underlines exactly why the Bank of England need to keep monetary policy at a very easy setting. It is far too soon for the monetary sceptics to start thinking about no more QE. The UK economy is a long way off even moderate health. With retail sales dropping 1.3% in April after a 0.7% fall in March, the cracks in consumer confidence are clear to see. The pound in consumers’ pockets is being badly eroded by negative real wages, high energy and transport costs and the large bite being taken out by the government’s austerity policies. Rising taxes are taking a huge toll on consumers’ disposable incomes and confidence to spend.

There are two ways out of the dilemma. Either the Bank of England needs to drop interest rates down to zero and ply the UK economy with massive quantitative easing. Or else the government needs to effect a U-turn on its austerity measures and start spending for recovery and growth. What would work best would be a compromise on both sides. Rather than working in isolation and at odds, the Bank of England and the UK government need to work together with much more effective and long lasting counter-cyclical economic stimulus. The BOE seem ready, but the government’s commitment is sadly lacking.

Sound bites: UK BOE leaves policy unchanged - waiting for Carney

It’s all about waiting for Carney. It’s no great surprise that the Bank of England has left policy in fast cruise control, leaving it until Carney arrives before deciding whether to shift policy stimulus up a few more gears. There is no doubt about it, there is still a lot of work to do bringing the UK economy back to life. While there are some early signs of spring in the recovery’s step, the UK still needs a lot of intensive care. Right now, the Bank is working hard to over-compensate for the stimulus being removed by the government’s tough fiscal austerity. Sadly the economy is still at a relative standstill and needs a lot more injection of monetary stimulus to jumpstart it into stronger life.

Receding inflation pressures, low wages growth and weak economic demand means there is nothing to fear from adding extra monetary stimulus. There is plenty of slack in the economy for the BOE to do more without the risk of sparking overheating pressures. As UK rates are at rock bottom, it means that the door to more QE must remain wide open ahead. The latest weakness in retail sales underlines the risks to the economy. Consumer confidence is still in a parlous state and the Bank needs to ensure that economic demand is fully propped up and well before the debate about unwinding QE enters into the equation. We are a long way off from that stage.

Tuesday, 21 May 2013

Sound bites: UK inflation drops to 2.4% in April from March's 2.8%

The sharp drop in UK headline inflation from 2.8% to 2.4% should come as welcome relief to the Bank of England. But it still bodes ill for the UK economic outlook. The UK’s slowing rate of inflation, low wage growth and the tepid pace of recovery are all clear signs that UK economic policy is still far too tight. The Bank of England may be doing their level best to prop up the economy with ultra loose monetary policy, but the government’s extremely tight fiscal policy is still wreaking huge damage on growth prospects. Unless the government changes direction quickly, it risks condemning the economy to bouncing along the bottom of sub-par growth for years.

The message for monetary policy is that the Bank of England must continue to bear the brunt of anti-austerity stimulus for a long while. With inflation coming down, wage growth so low and unemployment remaining relatively high, there is little risk of the Bank’s monetary measures spilling over into economic overheating. There is little chance of UK rates going back up for some time to come, possibly not until 2015.

Thursday, 16 May 2013

Sound bites: no Eurozone inflation pressures - headline inflation at 1.2% in April vs 2% ECB target

With headline inflation running so low below the 2% target and the Eurozone so deeply steeped in recession, it proves the ECB’s policy settings are still far too tight. This is a clear green light to the ECB to ease monetary policy again very quickly. With disinflation trends already entrenched, at some stage the ECB will need to start worrying that the next step could be deflation. The ECB cannot to afford to be complacent as any delay would be at the Eurozone’s peril. If deflation risks set in it would be very hard to vanquish as Japan is learning to its cost right now.

On both sides of the price equation, inflation pressures are extremely light. On the demand side, the recession is keeping a lid on domestic prices and wages, especially while unemployment mounts. On the supply side, energy and commodity price rises are less of a threat, especially while the strong euro remains such an effective inflation foil. With money supply growth and headline inflation running so low below target, the ECB has no reasonable excuse not to ease again soon. In fact it is imperative that they act very quickly to avoid getting further behind the curve on easing. The ECB have dragged their feet far too long. Mercifully, Draghi seems to be picking up the baton for a more much proactive approach than his predecessor Trichet.

While the rate cutting cycle is close to the end of its cycle, there is plenty more the ECB can do through conventional and unconventional means. The ECB should ensure it plies the Eurozone with plenty of excess liquidity to turn domestic credit contraction into credit expansion. It needs to get much stronger lending flows through to consumer and corporate borrowers to fuel stronger economic activity. The ECB also needs to exorcise its demons and consider extra monetary measures through quantitative easing. If the US and Japan can succeed in propping up their economic recoveries through quantitative easing, it is an anathema that the ECB needs to vanquish very soon for the Eurozone economy’s sake.

Wednesday, 15 May 2013

Germany's IG Metall agrees a 5.6% pay deal in Bavaria. Is it a big game-changer?

Germany's powerful IG Metall industrial union has agreed to a staggered wage deal in the key state of Bavaria, which will see wages in the metals and electrical engineering industries rise 5.6% over the next 20 months. If this serves as a pilot for other German regions, will this be a big game-changer, setting the scene for a German consumer-led recovery as some seem to be claiming in Germany right now?

If the deal in Bavaria succeeds in setting the benchmark for the rest of Germany, it will have positive ramifications for the recovery. A pay rise worth 5.6% over the next 20 months beats inflation and substantiates the rising trend of real wages in Germany. It will boost consumer confidence especially as it is backed up by a reasonably strong labour market at the moment. Whether it is going to be the saving grace for sustainable economic recovery is a different question. German consumers tend to be perennially cautious and the propensity to save in uncertain times tends to dominate thinking. The GfK consumer sentiment index has risen to a 5-year high, but optimism is still relatively flat and flaccid compared to previous upturns. The IG Metall deal will help, but the odds for a substantive consumer-led recovery at this juncture are not overwhelming.

For the time being, Germany has to rely on its age-old, time-tested export-led recovery at this stage. That model tends to be driven by faster exports, feeding into stronger output and investment intentions, with stronger employment and consumer spending bringing up the rear. Nothing changes the picture this time around. Germany might have been spared recession in the current round, but the economy is not out of danger yet. Consumers will do their bit in the recovery process, but it will be the general health of the world economy and the Eurozone and the impact on German exports which will still carry the whiphand

Sound bites: The Eurozone sinks deeper into recession - 1st quarter GDP drops by 0.2% qoq

The Eurozone is sinking deeper into recession and economic policy needs a radical rethink. This current recession is now longer than the 2008-2009 downturn and has no chance of abating soon, without a quick and substantive u-turn in Eurozone monetary and fiscal policies. Economic sentiment is on the rocks thanks to the debt crisis, inappropriately tough austerity policies and rising unemployment. The demand picture remains deeply depressed right across the board. Consumers are reeling, companies remain deeply cautious, governments are cutting back and the global trade outlook remains uncertain. The only potential bright spot is Germany which has been spared recession. Sadly German recovery at this stage is far too tepid to offer any meaningful help to the rest of the Eurozone. A change of policy direction is needed – and quick. Germany decoupling from the rest of the Eurozone simply rubs salt into a deepening political wound.

Eurozone policymakers need to redouble their efforts. As ECB rate cuts may be close to an end, the ECB must turn to unconventional monetary measures soon. A switch to quantitative easing must be applied. The ECB needs to pick up the QE baton in the same way as the US Fed and Japan’s BOJ to promote growth. It needs to flood the Eurozone with excess liquidity especially while inflation risks are so low, to help refloat recovery expectations. At the same time, Eurozone governments need to abandon tough austerity in favour of fiscal policies promoting growth.

Without a change of direction soon, the odds are that the recession will extend through 2013 and spill over into 2014. A deepening recession would imply no going back with growing risks of the Eurozone blowing apart in the future.

(percentage change)

2013 2012

EURO ZONE Q1 POLL Q4 Q3 Q2

pct change q/q -0.2 -0.1* -0.6 -0.1 -0.2

pct change y/y -1.0 -0.9** -0.9 -0.7 -0.5

2013 2012

EURO ZONE Q1 POLL Q4 Q3 Q2

pct change q/q -0.2 -0.1* -0.6 -0.1 -0.2

pct change y/y -1.0 -0.9** -0.9 -0.7 -0.5

EUROPEAN UNION

pct change q/q -0.1 -0.5 0.1 -0.2

pct change y/y -0.7 -0.6 -0.4 -0.3

* Reuters poll of 34 economists, range -0.7 to 0.1 pct

** Reuters poll of 25 economists, range -1.5 to -0.6 pct

Tuesday, 14 May 2013

Sound bites: Germany just avoids recession in the first quarter - GDP rises by a slender 0.1% qoq

Germany can breathe a huge sigh of relief as it has avoided recession in the first quarter by the skin of its teeth – by a bare 0.1% expansion. Germany may be emerging into the light of recovery but it can ill-afford to rest on its laurels. Germany’s fate is still inextricably tied in with the rest of the Eurozone and the outlook there still remains deeply at risk. There are potential problems looming between Germany and France now as their respective economic outlooks continue to diverge. It is a tale of two economies. Germany sowing some seeds of recovery, while the French economy is in trouble, dipping back into a second successive recession in less than two years.

Germany may be showing some bright spots but it is by no means out of the woods. German industrial order books, output and exports may be picking up momentum, but there are still dead spots in the economy. Stronger domestic demand is still being thwarted by perennially cautious consumers, while construction is still a net drain on German growth. Whatever benefits may accrue to German exporters from the US and Japan’s massive monetary mobilisation to spark global recovery, the Eurozone debt crisis remains a major millstone round Germany’s neck. German policymakers need to think outside the box.

German recovery still needs careful nurturing with sympathetic monetary and fiscal policies – not just domestically but throughout the Eurozone as well. Germany needs to give full backing to the ECB’s stimulus efforts to boost recovery and give its blessing to Eurozone governments to water down deep austerity constraints. Germany and the Eurozone need to pull together and grow their way out of trouble. Germany needs to work in unison, not in isolation.

Sound bites: Eurozone industrial production excells with a 1.0% mom jump in March

At long last, the Eurozone has some good news on the economy even though it is mainly thanks to the strong German recovery and a cold weather fuelled jump in energy output. It is a relief to see a change from the dour news that has dominated from the debt crisis in recent months. It will still be a long haul out of recession for the Eurozone, but at least Germany is leading the way to recovery. Besides the 3.8% mom jump in energy output due to the cold weather spell at least there are some other bright spots. Output of durable consumer goods jumped by 1.9% mom, perhaps indicative of some embryonic life coming back into Eurozone consumer sentiment. Capital goods production increased by 1.2% mom, suggesting some signs of recovery in the global investment cycle, even though it may be bypassing capital restructuring in the Eurozone outside of Germany.

The jump in Eurozone industrial production in March is not the end of the story. Nor does it let Eurozone policymakers off the hook. There is a long way to go before the Eurozone economy is out of the woods on recession. The ECB needs to ply a lot more monetary stimulus across the board to fuel recovery. Eurozone governments also need to effect a massive U-turn away from austerity, back towards counter-cyclical fiscal stimulus. Mercifully, some EU governments are already starting to throwing off the shackles of deep budgetary restraint, but there is still a long way to go. The Eurozone will still be steeped in recession throughout 2013, but it will depend on a deep change of heart to ensure recession does not endure through into 2014. It is not over yet.

Industrial production - monthly variation

pct change compared with previous month (seasonally adjusted)

Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13

EA17

Total industry -0.7 -0.7 0.7 -0.6 0.3 1.0

Intermediate goods -0.7 -0.9 0.2 -0.1 -0.2 -0.1

Energy -1.0 -0.4 -1.4 0.1 1.9 3.8

Capital goods -1.9 0.2 0.8 -1.7 0.9 1.2

Durable consumer goods -1.7 -1.3 1.9 -1.8 0.7 1.9

Non-durable consumer goods 0.9 -1.4 2.0 0.2 -1.5 -0.7

EU27

Total industry -0.5 -0.6 0.6 -0.5 0.3 0.9

Intermediate goods -0.6 -0.9 0.3 -0.2 0.1 -0.2

Energy -0.9 -0.1 -0.8 -0.3 1.2 3.0

Capital goods -1.5 0.2 0.8 -1.4 0.6 1.2

Durable consumer goods -0.5 -1.7 1.1 -0.7 -0.2 2.2

Non-durable consumer goods 0.5 -1.3 1.4 0.7 -1.4 -0.2

pct change compared with previous month (seasonally adjusted)

Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13

EA17

Total industry -0.7 -0.7 0.7 -0.6 0.3 1.0

Intermediate goods -0.7 -0.9 0.2 -0.1 -0.2 -0.1

Energy -1.0 -0.4 -1.4 0.1 1.9 3.8

Capital goods -1.9 0.2 0.8 -1.7 0.9 1.2

Durable consumer goods -1.7 -1.3 1.9 -1.8 0.7 1.9

Non-durable consumer goods 0.9 -1.4 2.0 0.2 -1.5 -0.7

EU27

Total industry -0.5 -0.6 0.6 -0.5 0.3 0.9

Intermediate goods -0.6 -0.9 0.3 -0.2 0.1 -0.2

Energy -0.9 -0.1 -0.8 -0.3 1.2 3.0

Capital goods -1.5 0.2 0.8 -1.4 0.6 1.2

Durable consumer goods -0.5 -1.7 1.1 -0.7 -0.2 2.2

Non-durable consumer goods 0.5 -1.3 1.4 0.7 -1.4 -0.2

Industrial production - annual variation

pct change compared with same month of the previous year (working day adjusted)

Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13

EA17

Total industry -3.1 -4.0 -2.1 -2.5 -3.2 -1.7

Intermediate goods -4.2 -5.6 -4.8 -4.1 -3.1 -4.6

Energy -0.3 -0.3 -0.3 -1.1 -6.5 9.2

Capital goods -3.6 -4.4 -1.8 -3.9 -3.8 -3.1

Durable consumer goods -5.3 -6.5 -2.7 -7.3 -5.1 -2.2

Non-durable consumer goods -1.9 -2.3 -0.3 1.8 0.6 -3.1

EU27

Total industry -2.9 -3.6 -2.1 -2.5 -2.6 -1.1

Intermediate goods -3.7 -5.0 -4.4 -4.3 -2.7 -4.0

Energy -1.5 -1.1 -0.6 -1.2 -6.2 6.7

Capital goods -3.0 -3.8 -1.5 -3.2 -3.0 -2.1

Durable consumer goods -3.4 -5.6 -3.0 -5.3 -4.3 -0.7

Non-durable consumer goods -1.7 -2.1 -1.0 1.1 1.0 -1.8

Sound bites: German ZEW economic sentiment stabilises at 36.4 in April (versus 36.3 in March)

It looks like German ZEW economic sentiment is throwing off the recent Cyprus crisis wobble and starting to show signs of stabilising. In the last few months there has been a clear disconnect between what the German business surveys and the real economy data and markets have been saying. German business sentiment surveys like ZEW and IFO have been tapping into a deep vein of negative energy due to the Cyprus crises. Meanwhile, German real economy data like industrial orders and production and trade data appear to be much more upbeat as the German recovery starts to get into its stride again.

Germany seems to have avoided recession in the first quarter by the skin of its teeth and the positive forward momentum seems to have re-engaged. The German equities markets now seem to be deriving a lot more positive drive from the hard data rather than the surveys. It is probably time for them to come back into synch again and for the surveys to start reflecting the positive economy story rather than the old news coming out of the Eurozone debt crisis.

It looks like the Eurozone is over the worst of the debt crisis for the time being. While the Eurozone authorities seem to be succeeding in managing the short term disturbances like Cyprus, it gives the markets an opportunity to focus on more of the positive aspects of the recovery story coming out of Germany. The Eurozone is not out of the woods by any stretch of the imagination. As the explosion of central bank money from the US and Japan continues to heal the global economic picture, the German recovery should be able to harness more upward momentum as the export outlook brightens.

Germany and the troubled Eurozone economies are poles apart in terms of where they are in the recovery cycle and Eurozone policymakers should not confuse them. While Germany continues to pull away, the rest of the Eurozone still needs a lot more stimulus efforts from the ECB and government fiscal policies before the Euro area is off the recession rocks.

Subscribe to:

Comments (Atom)