The Eurozone CPI data signals an imminent ECB rate cut. March inflation dropped to 0.5% from 0.7%. Eurozone inflation is sliding inexorably towards deflation. The ECB is duty

bound to ease monetary policy very quickly. This week’s ECB policy meeting

should be a catharsis. The options are clear. The recovery is struggling.

Unemployment is close to a record high. And deflation risks are pressing. It is

High Noon for a radical policy move this week. The ECB can move interest rates

into negative territory. It can give the green light to real quantitative

easing. The ECB can build up the whispering campaign for a weaker euro. It can

enact one at a time, or it can be radical and do them all together. Clearly,

the ECB has nothing to lose. Traditional opposition from Germany’s Bundesbank

already seems to have melted away. Bundesbank Chief Weidmann has already given

tacit support for all three policy initiatives. The way ahead is clear. The ECB

simply has to seize the moment and set the Eurozone on course for a

sustainable, job-creating recovery ahead. The key casualty will be the euro.

Right now it is standing on a trapdoor. It will fall very far and fast. At

return towards fair value around USD1.20 looks a safe bet in the coming months.

New View Economics is an independent consulting group. Macroeconomics and forecasting the financial outlook is the name of the game, using a holistic approach to getting the markets right.

Monday, 31 March 2014

Friday, 28 March 2014

Sound bites: Eurozone economic confidence showing a brave face. Or is it?

The March Eurozone economic sentiment index jumped to 102.4 from 101.4 in the prior month. Superficially, it looks like it is all speed ahead for economic confidence

in the Eurozone. Or is it? So far, the Eurozone sentiment index is brushing off

the negative impact of the Ukraine crisis, that is already starting to show up

in the German data. Recent German IFO, ZEW and PMI surveys have already alluded

to a dip in sentiment thanks to the escalation of risks emerging from the

Ukraine. It is all a question of how long before the crisis starts to cast

deeper shadows across the whole of the Eurozone. Economic optimism has been in

a strong positive uptrend since the 2011-12 recession. If economic confidence

starts to crumple this could have serious consequences for consumer and

business spending and investment plans ahead, putting the recovery at risk.

This will make monetary stimulus efforts doubly difficult for the ECB. The odds

are very strong still that next week’s ECB meeting will have to debut

‘alternative measures’ to rejuvenate stronger growth prospects. The Eurozone

recovery outside Germany is still flagging badly. It will either mean a dip

into negative interest rates, a shift to full-blow quantitative easing, or

stronger attempts to weaken the strong euro. It might even see a three-pronged

attack encompassing all three policies.

Thursday, 27 March 2014

Sound bites: UK consumers coming back

UK retail sales have rebounded back with a vengeance,

surging 1.7% in February, up 3.7% from a year ago. There is good and bad news

in the UK retail sales data. On the positive side, UK consumers are brushing

off the negative effects of recent bad weather and are spending again. Consumer

confidence is on the rise thanks to falling unemployment and the recovery in

the UK housing market. Confidence about the future is rallying. Stronger

consumer demand means that the UK economy is getting onto a sustainable

recovery track. On the negative side, this corroborates the Bank of England’s

view that they need to normalise UK monetary policy as soon as they can

with a rise in interest rates. The policy whispers coming out of the BOE have

been a growing crescendo for higher rates. Carney’s recent suggestion that UK

rates will need to return to 3% is a clarion call for tougher rate action soon.

A UK rate rise by the summer is on the cards. With underlying UK GDP growth

running upwards of 3%, near zero interest rates are a glaring anomaly that

needs rectifying very soon.

Sound bites: Eurozone bank lending still strangling recovery

Weak bank lending is still strangling the Eurozone economic

recovery. The Eurozone banks have plentiful access to cheap money from the ECB,

but they are not passing it through to consumers or businesses who really need

it. Loans to the private sector continue to contract. Annual growth in loans to

Eurozone households and companies is in negative territory to the tune of an

underlying minus 3%. This is unsustainable in the long run. Without some quick

intervention by the ECB, the Eurozone recovery will wither on the vine. What

the Eurozone economy needs right now is much faster credit expansion, not

credit contraction. The Eurozone banks need to be deterred from holding onto

funds and encouraged to re-engage lending. The ECB can do this by cutting the

official deposit rate, the interest rate for holding money with the ECB, and

moving it into negative territory. This means banks will be charged for holding

funds rather than releasing them go into the economy. Eurozone M3 money supply

growth at 1.2% is well below the ECB’s 4.5% reference target rate. The ECB have

their work cut out to get the economy moving into the fast lane of recovery

again. Cutting Eurozone rates into negative territory, embarking into

quantitative easing and weakening the euro would be the best policy avenues

going forwards. Fortunately the latest whispers from the ECB and Bundesbank

suggest that the policy die-hards are finally starting to wake up to.

Tuesday, 25 March 2014

Sound bites: Germany's IFO's economic confidence dented

The March dip in Germany’s IFO index provides further

evidence that the Ukraine crisis is spilling over with negative effect to hurt

business confidence. Germany’s IFO, ZEW and PMI surveys are all agreed. German

business sentiment is being harmed and Germany’s recovery could be put at risk

the more the crisis deepens. If the Ukraine crisis escalates and tougher

economic sanctions are applied against Moscow, the 6,000-plus German firms that

trade with Russia will be in the firing line. The $75bn bilateral trade between

Russia and Germany could be hit hard, putting a massive dent in Germany’s

export growth. This is the last thing that Germany needs at the juncture when

self-sustaining recovery has been looking much more credible. It will be bad

news for the Eurozone as a whole, making the ECB’s recovery efforts doubly

difficult.

Tuesday, 18 March 2014

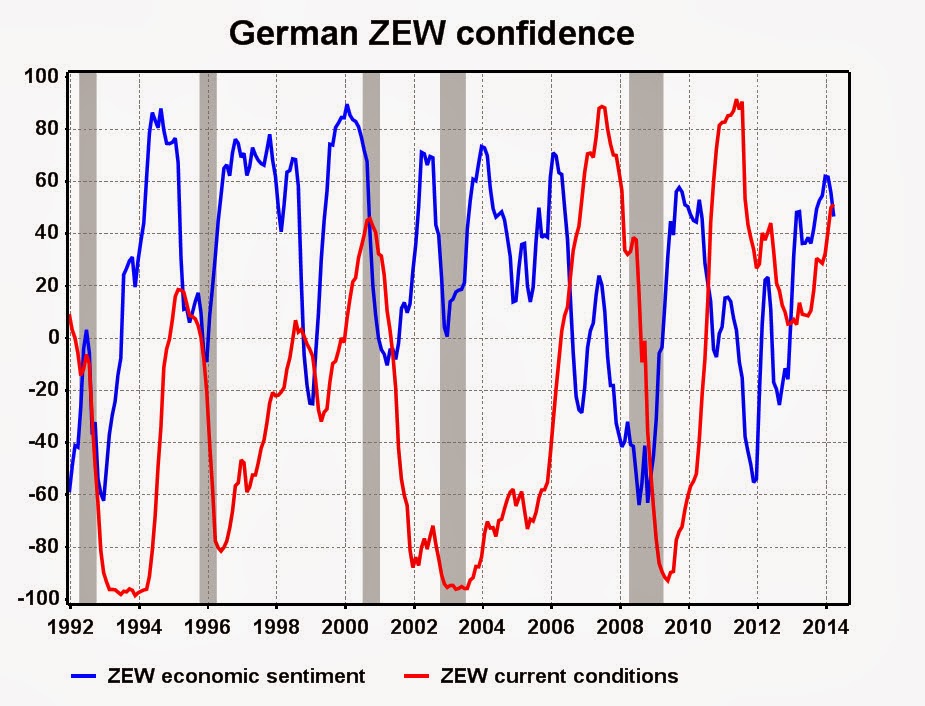

Sound bites: German ZEW index feels a chilly wind from the east in March

German economic sentiment crashed in March to 46.6 from 55.7

in February. Germany might have felt a growing sense of optimism that it is

leading the way to recovery in Europe, but March’s sharp decline in the ZEW

index underlines the frailty of economic confidence to the growing crisis in

the Ukraine. German equity markets have definitely felt the effects of chillier

political winds blowing in from the east so it was no surprise that the ZEW

index would catch a deep cold. The deeper the crisis plunges, the greater the

negative impact will be on economic sentiment and the greater the damage is

likely to be felt in the real economy in the coming months. Orders, output and

investment intentions will be put on hold and German consumers will be much more

worried about the future impact on employment prospects and disposable income.

It is a classic case of bad timing for the German recovery. The impact on

recovery prospects from the crisis in Eastern Europe will help focus the ECB’s

attention on the need to keep Eurozone monetary policy highly accommodative

ahead. The odds are rising that the ECB will need to cut rates again, this time

into negative territory. The Eurozone economy will need to be kept awash with

plenty of easy money ahead.

Thursday, 6 March 2014

Sound bites: ECB needs another rate cut

Without a doubt, the ECB needs another rate cut. High Noon

is approaching fast. The list of indictments on ECB policy failings is growing

rapidly. Eurozone economic confidence remains fragile. The embryonic recovery

risks slipping back into recession. Deflation remains an imminent threat. The

euro is too strong. The economy is subsumed by domestic credit contraction. The

banks are not lending. Consumers and businesses are not borrowing. The Eurozone

is already awash with liquidity. The ECB throwing more money into the pot is

hardly going to make much difference. The money is not getting through to the

parts of the economy that really need it. The ECB needs to incentivise the

banks into lending more. One way to do this is to cut the official deposit rate

into negative territory charging the banks for holding money at the ECB.

Without the lifeblood of cheaper, more abundant bank lending, the Eurozone

recovery will wither on the vine. The odds are that the ECB will need to keep

rates close to zero for years to come.

Sound bites: BOE wants to normalise policy as soon as it can

The Bank of England is in an enviable position. The economic

outlook remains stable and it can afford to pick its moment to strike with

tighter policy when it likes. The time is not ripe for higher rates just yet,

but it may come sooner than the market is expecting. The UK recovery is showing

the best economic comeback in the G7. The inflation outlook remains well

balanced, with the headline rate only just dipping below target. Employment

conditions are improving. And sterling is gaining a firmer foothold given its

recent safe haven appeal. There is a very good chance that the Bank will be

aiming to start the ascent to higher rates by mid-year. UK monetary policy has

been travelling off-road for too long and the Bank wants to get policy back

onto the planned route as soon as it can. The economy is providing all the

right sat nav signals to normalise rates as soon as it deems it is ready to go.

Sound bites: German new orders still fail to excite

There was a slightly stronger than expected 1.2% rebound in

German new orders in January, but overall demand conditions still fail to

excite any true notion of confidence ahead. Germany’s economy remains well

behind in the recovery stakes. There a massive gulf between German optimism and

economic reality. Considering all the huge stimulus thrown at the Eurozone

economy in the last few years, German new order books are still lagging badly

behind. German exporters are failing to exploit their dominant position in the

global demand for manufactured machinery and capital goods. Despite the fragile

GDP upturn in the last three quarters, Germany is still not showing any signs

of budding economic spring. The ECB still needs to get back down to the policy

drawing board to design more vibrant and sustainable recovery ahead for Germany

and the Eurozone. It is High Noon for ECB policymakers, especially with a dip

into deflation lurking round the corner.

Subscribe to:

Comments (Atom)