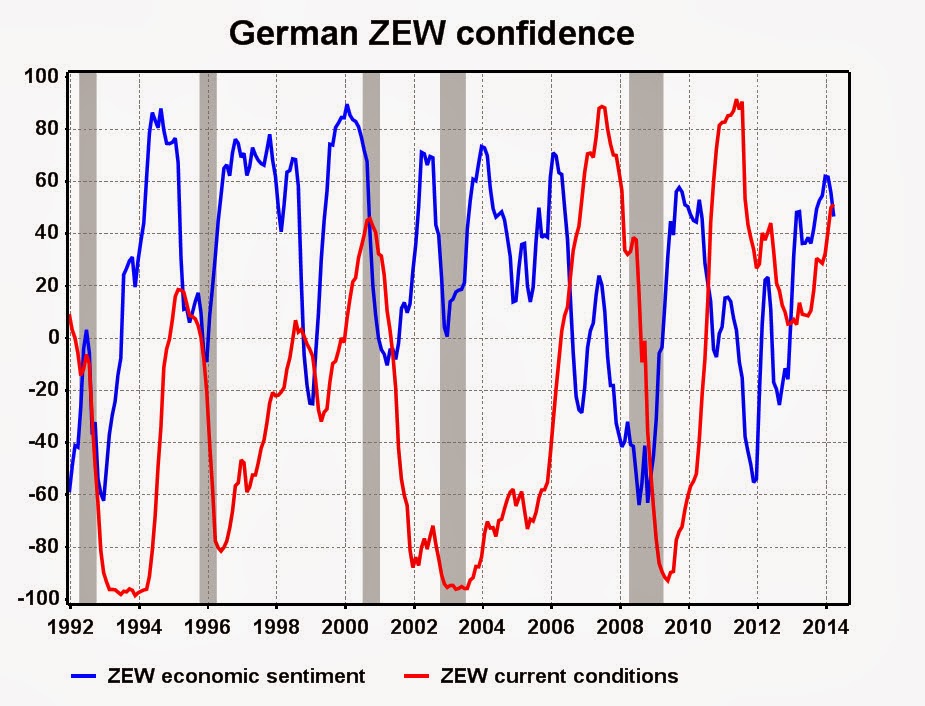

German economic sentiment crashed in March to 46.6 from 55.7

in February. Germany might have felt a growing sense of optimism that it is

leading the way to recovery in Europe, but March’s sharp decline in the ZEW

index underlines the frailty of economic confidence to the growing crisis in

the Ukraine. German equity markets have definitely felt the effects of chillier

political winds blowing in from the east so it was no surprise that the ZEW

index would catch a deep cold. The deeper the crisis plunges, the greater the

negative impact will be on economic sentiment and the greater the damage is

likely to be felt in the real economy in the coming months. Orders, output and

investment intentions will be put on hold and German consumers will be much more

worried about the future impact on employment prospects and disposable income.

It is a classic case of bad timing for the German recovery. The impact on

recovery prospects from the crisis in Eastern Europe will help focus the ECB’s

attention on the need to keep Eurozone monetary policy highly accommodative

ahead. The odds are rising that the ECB will need to cut rates again, this time

into negative territory. The Eurozone economy will need to be kept awash with

plenty of easy money ahead.

No comments:

Post a Comment